Introduction:Apple Pay work

Apple Pay work : In today’s fast-paced digital world, convenience is king, and Apple Pay stands out as a key player in revolutionizing how we handle transactions. Whether you’re grabbing a coffee, shopping online, or even splitting a bill with friends, Apple Pay makes payments quick and seamless. But how exactly does this technology work? Let’s dive deep into the world of Apple Pay to understand its mechanics, benefits, and potential drawbacks.

What is Apple Pay?

Apple Pay is a mobile payment and digital wallet service by Apple Inc. It allows users to make payments in person, in iOS apps, and on the web. Launched in October 2014, Apple Pay has steadily grown in popularity, offering a secure and private way to pay with your iPhone, Apple Watch, iPad, and Mac.

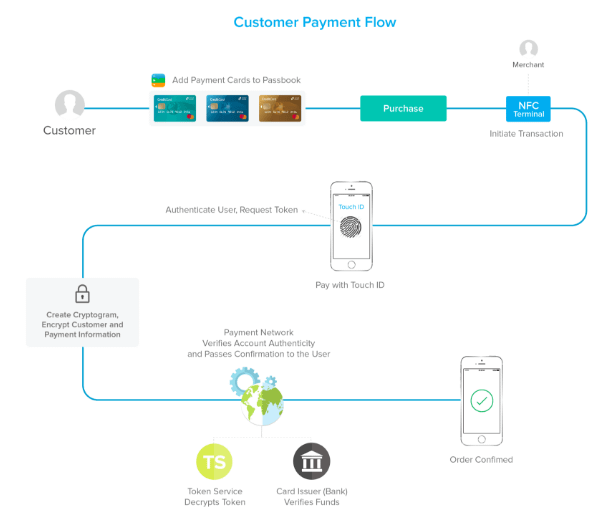

How Apple Pay Works

Apple Pay leverages Near Field Communication (NFC) technology to enable contactless payments. It uses a process called tokenization, replacing sensitive card information with a unique identifier, or token, during transactions. Supported devices include iPhone 6 and later, Apple Watch, iPad Air 2 and later, and Mac models with Touch ID.

Setting Up Apple Pay

To get started with Apple Pay, you need an eligible device, the latest version of iOS, watchOS, or macOS, and an Apple ID signed into iCloud. Here’s a quick setup guide:

- Open the Wallet app on your iPhone.

- Tap the ‘+’ sign to add a new card.

- Follow the on-screen instructions to add your credit or debit card.

- Verify your card with your bank or card issuer.

Adding Cards to Apple Pay

Apple Pay supports a variety of cards, including credit, debit, prepaid, and store cards from participating issuers. To add a card:

- Open the Wallet app.

- Tap ‘Add Card’.

- Use your iPhone camera to capture your card information or enter it manually.

- Follow the instructions provided by your bank for verification.

Making Payments with Apple Pay

In-Store Payments: To pay in stores, look for the contactless payment symbol. Hold your iPhone near the contactless reader with your finger on Touch ID or use Face ID. A subtle vibration and beep confirm your payment.

Online and In-App Payments: For online purchases, select Apple Pay at checkout. Authenticate with Touch ID, Face ID, or your passcode. This method streamlines the process, eliminating the need to manually enter shipping and billing information.

Security Features of Apple Pay

Security is a top priority for Apple Pay. It uses several layers of protection, including:

- Encryption and Tokenization: Your actual card number is never stored on your device or Apple servers. Instead, a unique Device Account Number is assigned, encrypted, and securely stored in the Secure Element of your device.

- Biometric Authentication: Transactions require your fingerprint, face, or passcode, adding an extra layer of security.

Where Can You Use Apple Pay?

Apple Pay is accepted at millions of locations worldwide. You can use it at:

- Retail Locations: Many major retailers, restaurants, and service providers accept Apple Pay.

- Apps and Websites: Use Apple Pay for purchases in apps and on participating websites using Safari.

Apple Pay and Public Transportation

Apple Pay simplifies commuting by allowing you to pay for public transportation in various cities globally. Just tap your device at the transit terminal and go. It’s a quick and efficient way to manage your daily travel without fumbling for a card or cash.

Apple Pay Cash and Peer-to-Peer Payments

Apple Pay Cash lets you send and receive money directly through the Messages app. It’s perfect for splitting bills or sending a quick gift. Simply open a conversation in Messages, tap the Apple Pay button, and choose the amount to send. The money is securely transferred to the recipient’s Apple Pay Cash card in their Wallet.

International Usage of Apple Pay

Apple Pay is available in over 60 countries and regions. When traveling, you can use Apple Pay just like you do at home, with your purchases being converted to the local currency. Ensure your cards are enabled for international use to avoid any hiccups.

Benefits of Using Apple Pay

- Convenience: No need to carry physical cards; your devices are your wallet.

- Enhanced Security: Advanced security features protect your transactions and personal information.

- Speed: Quick and easy payments without the hassle of entering card details.

Potential Drawbacks of Apple Pay

- Limited Merchant Acceptance: While growing, not all merchants accept Apple Pay.

- Dependency on Apple Devices: Apple Pay is exclusive to Apple products, limiting its accessibility for non-Apple users.

Apple Pay vs. Other Mobile Payment Systems

When comparing Apple Pay to other mobile payment systems like Google Pay and Samsung Pay, several unique features stand out:

- Integration with Apple Ecosystem: Seamless integration with other Apple services and devices.

- Security: Robust security measures with biometric authentication and tokenization.

Future of Apple Pay

The future of Apple Pay looks promising with continuous enhancements and expanding acceptance. Upcoming features might include more integration with smart home devices and further improvements in security and user experience. As the digital economy evolves, mobile payment systems like Apple Pay will likely become even more integral to our daily lives.

FAQs: Apple Pay work

- Is Apple Pay safe to use? Yes, Apple Pay is highly secure, using encryption, tokenization, and biometric authentication to protect your transactions and personal information.

- Can I use Apple Pay without an internet connection? Yes, you can use Apple Pay for in-store transactions without an internet connection. However, an internet connection is required for online and in-app purchases.

- Which devices support Apple Pay? Apple Pay is supported on iPhone 6 and later, Apple Watch, iPad Air 2 and later, and Macs with Touch ID.

- Are there any fees for using Apple Pay? No, Apple does not charge any fees for using Apple Pay. However, your bank or card issuer may have its own terms and fees.

- Can I add multiple cards to Apple Pay? Yes, you can add multiple credit, debit, and prepaid cards to Apple Pay and select which one to use for each transaction.

Pingback: who Ownership apple - appleratinghub.us

Do you mind if I quote a few of your articles as long as I provide credit and sources back to your weblog? My website is in the very same niche as yours and my visitors would certainly benefit from a lot of the information you provide here. Please let me know if this ok with you. Thanks a lot!

Based on my research, after a in foreclosure process home is available at a sale, it is common with the borrower in order to still have some sort ofthat remaining balance on the bank loan. There are many loan companies who attempt to have all fees and liens paid back by the subsequent buyer. However, depending on selected programs, legislation, and state regulations there may be several loans which are not easily settled through the exchange of personal loans. Therefore, the duty still rests on the consumer that has received his or her property in foreclosure. Thank you for sharing your opinions on this site.

Verified Stripe accounts simplify payment processing with global reach and reliability.

Searching for aged Stripe accounts? This provider offers the best.

Purchase verified Stripe accounts from this reputable and secure provider, offering peace of mind for your business.

Best merchant account for high risk operations available here.